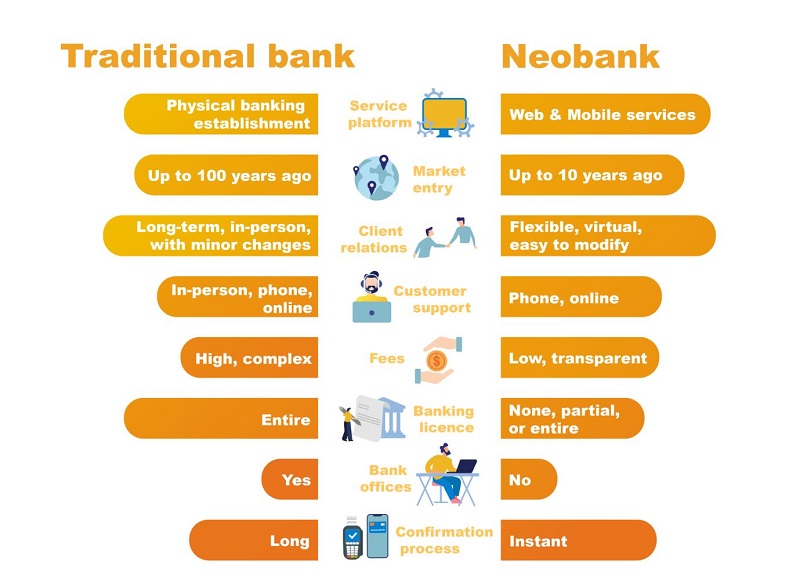

At the same time, there are already many “virtual” banks operating in the world, which have completely digitized their business processes, following the trend of moving to an online format. They are called “neobanks”. Experts from Boosty Labs fintech development company talk about why neobanks (https://boostylabs.com/neobank) are the new future after the coronavirus. Neobanks are fintech companies that offer standard banking services in an all-digital format. Unlike conventional banks, neobanks do not have physical branches and can operate without a banking license. Neobanks have begun to develop recently, but have already managed to conquer a large client base. The number of users of neobanks is expected to grow, which will have a positive effect on the turnover of companies. This trend can be explained by the fact that the success of neobanks is associated with a number of other advantages besides online service. Neobanks also offer:

High interest rates on deposits. Since neobanks have no branches and fewer employees, they can offer better interest rates on deposits; A simplified way to get loans. The process of obtaining loans from neobanks is more convenient and faster, because modern technologies are used to assess the client’s credit risk; Low rates. Often, neobanks do not charge a fee for servicing cards and transferring funds; and New solutions for financial analytics. In addition to the usual banking services, neobanks provide services for the automatic analysis of the movements of funds in the account and at the same time offer their users personalized financial solutions. The success of neobanks often depends on the regulatory environment and the actual needs of clients in a particular jurisdiction. At the moment, the most successful stories of launching neobanks are associated with Europe, where the UK is the leader among all countries.

The success of neobanks often depends on the regulatory environment and the actual needs of clients in a particular jurisdiction. At the moment, the most successful stories of launching neobanks are associated with Europe, where the UK is the leader among all countries. Some neobanks have received a full banking license, and their regulation is no different from ordinary banks. At the same time, specifically for the needs of neobanks, a number of countries have introduced a limited type of banking licenses, which are provided as an intermediate stage before obtaining a full-fledged banking license. In such cases, neobanks were able to increase their resources to fully enter the banking sector without reducing requirements from the regulator. This type of license is available, for example, in the UK and Australia.

Example 1: Monzo (UK).

Cooperation model with another bank Another model is that neobanks cooperate with existing banks. In this case, all obligations to comply with regulatory requirements, along with credit risks, lie with partner banks, while neobank provides only technological solutions.

Example 2: Chime (USA).

Mixed model Some neobanks only obtain licenses for some financial services and conduct other activities through partnerships with conventional banks. For example, in Europe, the EMI (Electronic Money Instutution) license allows a neobank to issue cards, transfer funds and issue electronic money. Other services, such as opening deposit accounts, can be provided by neobanks only through cooperation with ordinary banks.

Example 3: Bnext (Spain)

“Change or Die” The coronavirus epidemic has already affected consumer behavior and reshaped business processes around the world. Accordingly, traditional banks will be forced to respond to these changes in customer behavior patterns and now compete not only with each other, but also with fintech companies or neobanks that are not burdened with bloated staff and capital costs, and therefore are able to quickly increase their market share. The faster a business becomes aware of the changes that are taking place, the more chances they have to survive and succeed in a post-pandemic world, and the more opportunities for consumers to get a better product at a better price. And for new entrepreneurs, this is a great opportunity to immediately start building the business of the future.